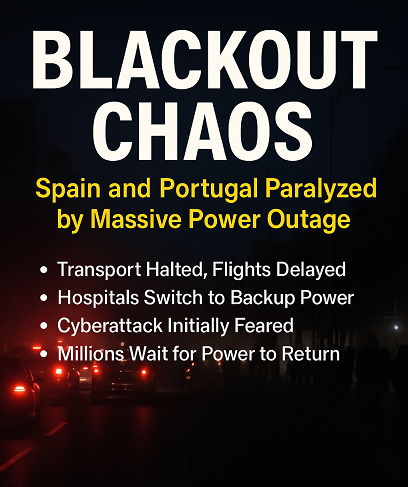

The latest tariff bombshell from U.S. President Donald Trump has sent global markets into a frenzy, with countries like Pakistan preparing for potential fallout. Trump recently unveiled a chart at the White House, detailing aggressive tariff hikes—34% on Chinese imports, 25% on South Korean goods, 32% on Taiwan, and steep duties on the EU and Japan.

These tariffs, aimed at protecting U.S. trade interests, are expected to spark retaliatory measures, disrupting global trade. Experts warn that Pakistan’s rupee could come under severe pressure as investors brace for economic uncertainty. Additionally, if the U.S. Federal Reserve maintains high-interest rates, Pakistan’s external debt burden could increase, making IMF repayments even more expensive.

South Korea, China, and Japan have pledged to counter these tariffs with joint economic measures, but their impact remains uncertain. For Pakistan, the risk of reduced exports, inflation, and capital outflows looms large. As global financial markets enter a volatile phase, policymakers must brace for economic shocks that could reshape international trade.